Forex trading is immersed in a lot of noise. There are thousands of resources available on it on the internet. It appears that different self-appointed gurus have different ideas of what traders are meant to be doing to be able to reap maximally from the Forex market.

But the most important thing: how do you find out what works and what does not? This is where this guide comes in. Here, we seek to separate the wheat from the chaff. The 6 tips highlighted, here, if diligently followed, will contribute immensely towards making you a successful trader.

- Pay attention to price action. The price is all there is.

Forextechnical analysis is based on one supposition:the price is all there is. This tip has become one of the most widely accepted tenets of Forex trading. And a derivative of this strategic technical analysis tip is what is called price action, which, as applied to Forex, is the study of the price of currency pairs.

This price action uses tools such as charts and their different patterns. Even, indicators, which are derivatives of price, are one of those tools. Examples of indicators used for the technical analysis of price are the Relative Strength Index (RSI) and Bollinger Bands.

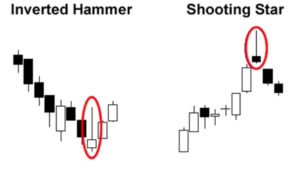

©Babypips.com

The different patterns of candlesticks such as inverted hammer and shooting star, morning and evening stars, and tweezers, can help you recognise prices, trendsand their reversals, and, overall, to make informed trading decisions.

- Identify support and resistance and trade close to them

As part of your overall price action strategy, you must learn to identify levels of support and resistance. Then, you must adhere to trading close to them. Support and resistance are benchmark levels that you must, as a successful Forex trader, not only be aware of but also commit to obeying.

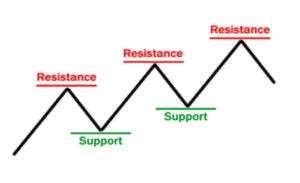

©Babypips.com

This is why.The resistance is the highest level the market reaches before it either pull backs or reverses in trend. On the other hand, the support level is the lowest level reached by the market before it turns again. Support and resistance, corroborated with reversal candlestick patterns,can offer one of the best trading opportunities.

It is essential to state that sometimes, the price moves beyond those predetermined levels. For instance, when the price goes beyond a particular resistance level, the level could become the next support. And when it breaks beyond a support level, that support level could become the next resistance.

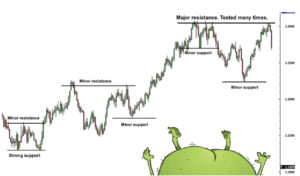

©Babypips.com

Finally, the message here is: learn to identify support and resistance. When you do, you could use them as a guide. Go long after the confirmation of support and go short when the resistance is confirme.

- The trend is your friend.

It is surprising that as commonly said as it is, only a few traders actually follow it. But really, the trend is your friend. That means that you should follow it. You should trust it. And when you do, trading becomes easier. You would not have to be worrying about what the market will do next since you are already following its trend.

Whenever you look at the charts, the first thing you should ask: what is the trend? Is the market bullish or bearish? Is the price making higher highs and higher lows? Or is it making lower highs and lower lows? Or maybe, there is no definite trend to it, in which case you can say it is ranging or consolidating.

What is the trend?

- If it has been ranging for long, be expecting a hard breakout anytime soon

The market is in a constant state of flux. As a result, it might not always maintain one trend for long. From a bullish or a bearish mode to a ranging trend, the market moves. Because of this, you should pay special attention to it. Especially, when it is ranging, you should be on the lookout.

Why? Because in a ranging market, as you would expect, most traders will want to buy at support and sell at resistance, with their stop-loss prices being set just below those levels.As a result of this, a cluster is formed around those levels, making the market range more.

At this point, a breakout can occur any time. And when it does, it usually continues in its chosen direction for long.

- Backtest

Make a promise to yourself that you will not trade with any strategyuntil you backtest it first. What is backtesting? Backtestingas a process enables traders to find out how well their strategies would have performed.

It aims to detect the viability of a trading strategy using historical data. A strategy that passes backtesting can then be confidently adopted, as it is believed that it will yield equally positive results in the future as it would have yielded in the past.

So, how do you backtest? Well, there are two ways; automated and manual. The automated way only requires you to use tools such as Expert Advisor (EA) or a charting software to test the validity of your chosen strategy over some years.

The manual method of backtesting, as the name implies, is done by painstakingly juggling from period to period, bar by bar, on the chart. This method, though more laborious, is more widely recommend than the automated one.

- Learn to trade breakouts

First, what is abreakout? As it implies, a breakout is form when the price is able to overcome a consolidating (ranging) market mode to go beyond it. That is, essentially, when there is a breakout, the pricebreaksbeyond either consolidation or an important price level such as support or resistance.

©Babypips.com

How do you trade breakouts? It is easy. Just check for the movement of the price beyond any of those predetermined, targeted levels and then ride on it. As long as the move is a strong one, all you have to do is to maintain your position until volatility starts to wane.

However, there is a warning. Beware of false breakouts. These are situations when the price breaks out of any of those predetermined levels but does not continue in its new direction. As a breakout trader, you should protect yourself against false breakouts. You can do this by not always taking the first breakout that you see.