A wide range of strategies can be applied when trading CFDs. To get the most out of your trading, it is essential to understand which strategies work best for you and how to apply them. This article will outline some of the most used CFD trading strategies and provide tips on using them effectively.

Using CFDs in rising and falling markets

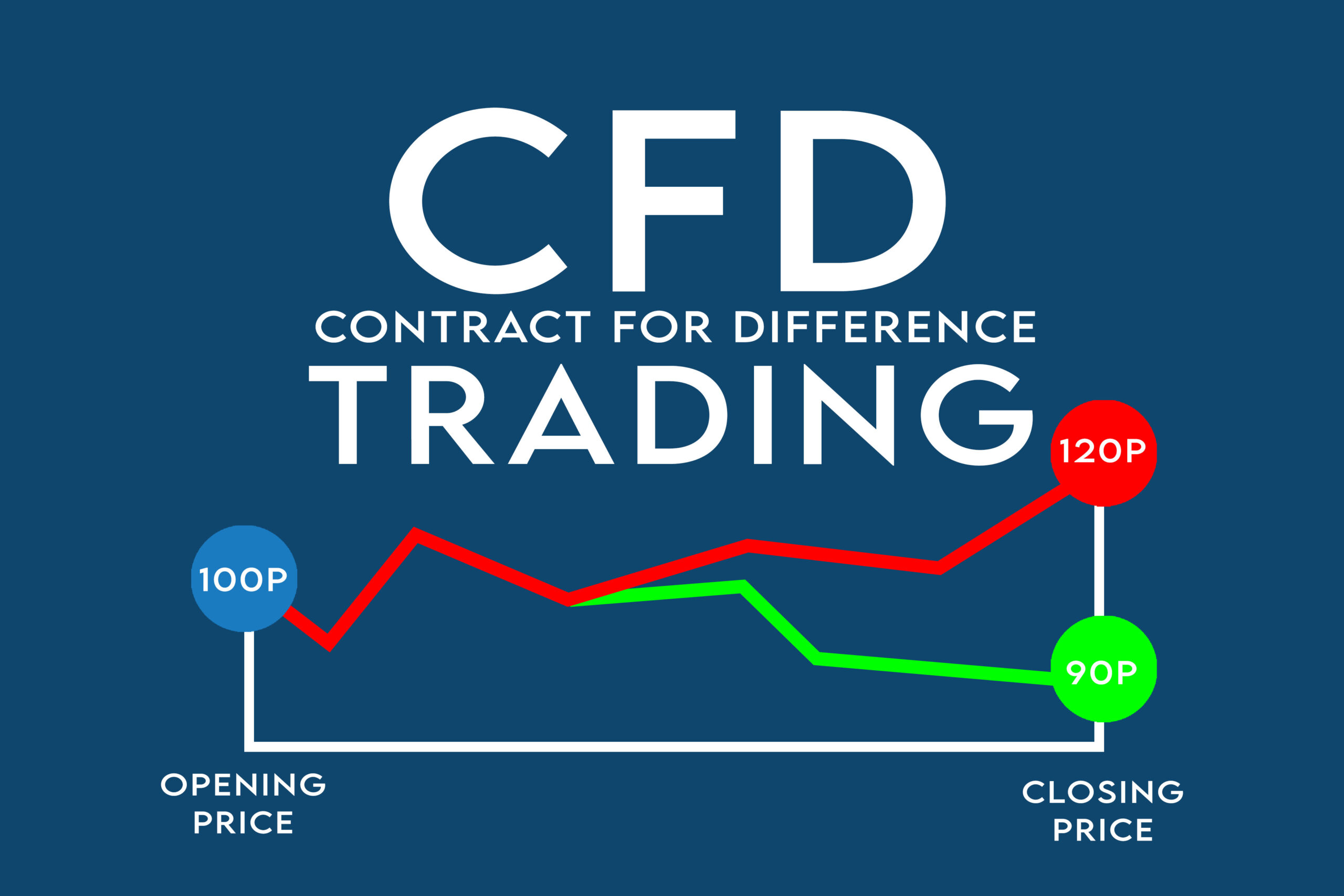

CFD stands for ‘contract for difference’, and they allow traders to speculate on the price movements of underlying assets. They are derivative financial products, which means that traders do not own the asset when they buy a CFD.

Traders can use CFDs to speculate on various markets, including stocks, forex, commodities, and indices. It is a popular form of investment because it allows traders to take advantage of rising and falling markets.

In addition, CFDs are leveraged instruments, meaning traders can control prominent positions with a relatively small amount of capital. This leverage can magnify profits and losses, so it is crucial to use stop-loss orders to limit downside risk.

With careful planning and risk management, CFD trading can effectively generate profits in both rising and falling markets.

CFD trading strategies

When trading CFDs, traders can take various approaches, depending on their goals and level of risk tolerance.

Some common strategies include trend-following, breakout trading, and scalping.

When it comes to trading, there are a variety of strategies that traders can employ to achieve success. Some common strategies include trend-following, breakout trading, and scalping.

Trend-following

Trend-following involves taking a position in the same direction as the current market trend in the hope that the trend will continue long enough for the trader to profit.

Breakout trading

Breakout trading involves taking a position when the price of an asset breaks out above or below a certain level.

Scalping

Finally, scalping is a strategy whereby traders take small quick profits by taking advantage of small price movements.

While there is no perfect strategy, by employing a combination of different approaches, traders can increase their chances of success.

Trading styles vary and that’s okay

It’s important to remember that no one strategy is guaranteed to work 100% of the time – it’s essential to find a strategy that suits your trading style.

Different traders have different styles and preferences, and what works for one person may not work for another. The most important thing is to find a strategy that suits your trading style.

Some people are more comfortable with short-term trades, while others prefer to hold positions for more extended periods. Some people like to take risks, while others prefer to play it safe.

There is no right or wrong answer – the key is to find a strategy that works for you. One way to do this is to experiment with different strategies and see which produces the best results. Another way is to speak to other traders and get their insights on what has worked for them.

Ultimately, the best strategy is the one that helps you achieve your goals and make consistent profits.

Always use stop-losses

Stop losses are an essential tool for managing risk. By setting a stop-loss order, you can automatically exit a trade if the market moves against you by a certain amount. This order helps to protect your capital from sudden losses and can also help reduce your overall risk exposure.

There are two main stop-loss orders: hard stop losses and soft stop losses. Hard stop losses are absolute, meaning the trade will be closed at the specified price regardless of market conditions. Soft stop losses, however, are adjustable and allow you to close the trade at a better price if the market starts to move in your favour again.

When using stop losses, carefully consider your trade setup and risk/reward ratio. Always remember that a stop loss is not a guarantee that your loss will limited to the specified amount, but it is still an essential tool for managing risk.

The final say

There is no guarantee that any one trading strategy will be successful, but a well-diversified portfolio and an understanding of how the markets work will give you the best chance for success. If you want to learn more about CFD trading, you can check out a reliable and reputable broker, such as Saxo markets.